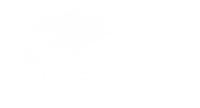

China Challenges - 300+ Million Elderly

- Aging diseases: including cancer, diabetes and cardiovascular diseases are 3 main killers in China

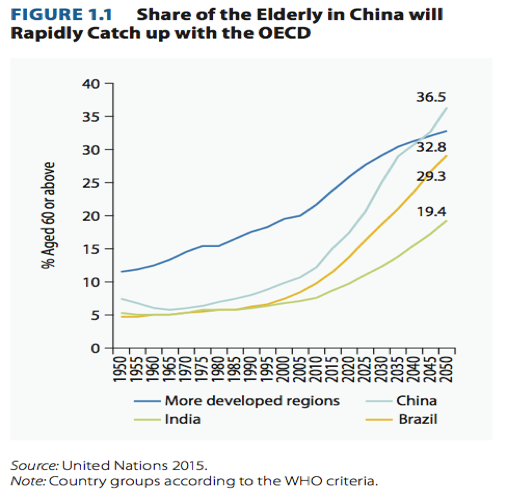

- In the past decade, healthcare costs grew at a rate of 5 to 10 percentage points higher than gross domestic product growth in China.

- In the last 20 years, China has improved health delivery services and achieved noteworthy success in health outcomes.

- China has greatly reduced child and maternal mortality and rates of infectious diseases, invested in expanding health infrastructure, and ensured near-universal health insurance coverage.

- After lifting more than 600 million people out of poverty in the past three decades, China now faces slower growth, an aging population, and a surge in non-communicable diseases.

- In the past decade, healthcare costs grew at a rate of 5 to 10 percentage points higher than gross domestic product growth. At the same time, with higher economic growth and personal incomes, people are demanding more and better health care.

- Those factors have led to rising healthcare costs. Yet the slowdown in the economy will make it difficult to keep up with the current level of growth in health spending.

- Decades ago, China’s innovations in health – barefoot doctors and community health care, for example – showed the world it was possible to improve the health and greatly increase the life-expectancy for hundreds of millions of people.

- China can once again lead the way with cutting-edge primary health care by enacting reforms that put patients first and shift away from expensive hospital care.

- The World Bank’s new joint report with the Chinese government and the World Health Organization recommends the country shift away from its current hospital-centric model, which rewards volume and sales, to one focused on health outcomes that is centered on primary care and offers better value for money.

- According to the study, without reform, health spending would increase in real terms from 3.5 trillion yuan in 2014 to 15.8 trillion yuan in 2035—an average increase of 8.4 percent per year. Health spending would account for over 9 percent of GDP in 2035, up from 5.6 percent of GDP in 2014. More than 60 percent of the projected growth in health spending would come from increased inpatient services in hospitals.

- The report proposes practical, concrete steps toward a value-based integrated service model of healthcare financing and delivery.

- The study estimates it will take China about a decade to fully implement the proposed reforms and reach full scale.

- If carried out, these reforms will improve the healthcare system for all Chinese people—or one in every six people in the world.

China Opportunities for UK

£1 Trillion+ Market

- UTotal Chinese Healthcare market is worth more than £1 Trillion, including Hospital: £290 Billion; Medical devices: £20 Billion; Pharmaceutical: £64.5 Billion.

- Summaries from DIT : UK-CHINA Life Sciences Export £1 Billion in 2015, predicted £2 Billion by 2021. Hospital build projects in China presents enormous opportunities for UK companies.

Work Measures

Early-stage guidance, full service

- Jointly study and make project landing plan;

- Plant drawings demonstration, document preview;

- Expert onsite guidance, simulated inspection;

- Regulation study, training & publicity.

2016 CHINA-UK Biotech DEALS

8 Big Deals-Companies in Different Stages

Department for international trade - £1 Billion +

- Haier Biomedical & Laboratory

- Pharmaron -Quotient Bioresearch & MSD UK Hoddesdon site

- Creat Group and Shanghai Raas Blood Products-BPL

- Hepalink & ORI Healthcare Fund -Kymab

- Wondfo Biotech-Atlas Genetics

- Aland Nutrition Europe B.V.-Brunel Healthcare Manufacturing Limited & Biocare Limited

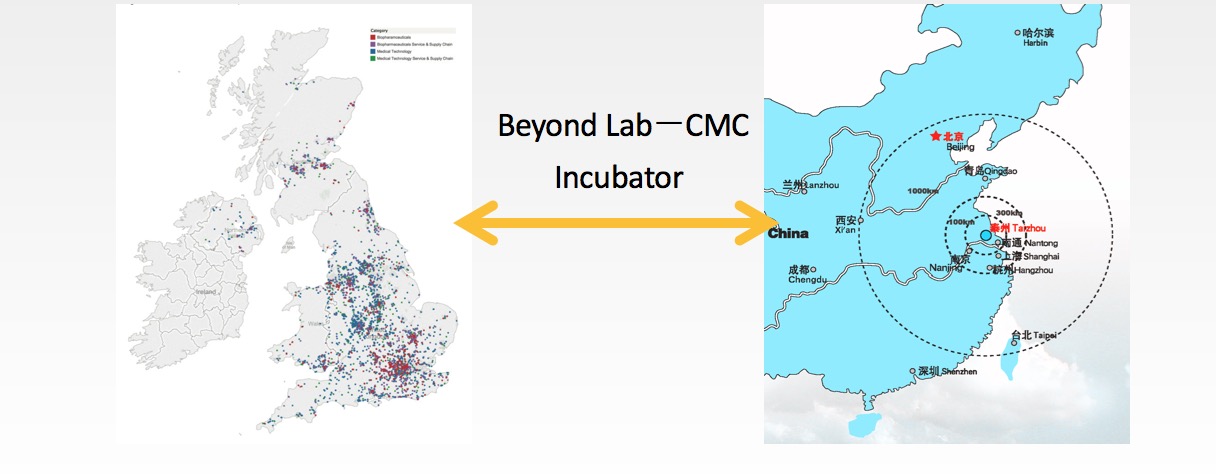

China Medical City-UK Incubator

A Bridge Between CHINA and UK

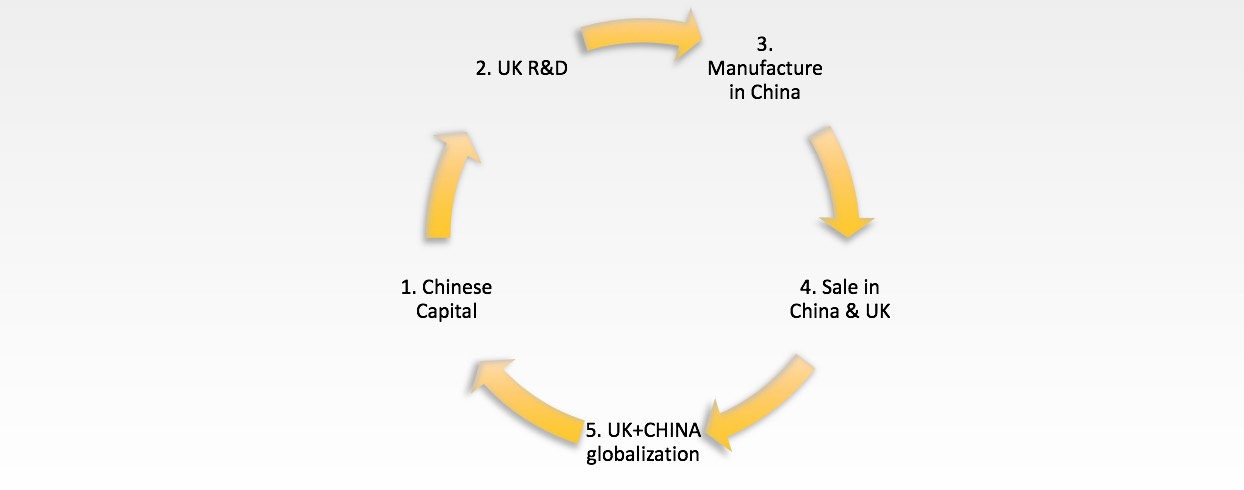

UK –CHINA Co-working MODEL

The First CHINA-UK Medical Incubator

- Raise Fund for UK firms before entering into CHINA (BL and Partners)

- Enhance the R&D in the UK and transfer technology/IP from UK to China, provide training supports for UK firms who want to enter Chinese Market (BL)

- Help the UK firms to obtain the CFDA approval, Commercializing UK technology/idea, manufacturing in CHINA (CMC), help to recruit UK talents to join the firms based in CMC (BL)

- Help the UK firm to market products/services in CHINA and other countries in Asia (CMC)

- Globalization in parallel from China (CMC) and UK (BL). Beyond Lab and partners (including Haitong Bank, CIC) will help mature Chinese businesses to carry out M&A/investment in the UK, therefore more capital can be injected into so-needed UK SM businesses

CMC-UK Incubator - London

- UK Training -3 months

- Short entrepreneurship course-language business, science, social life in China

- Bilingual mentor at PhD Level

- Professional Advisors on finance, legal and taxation in China

- Full supports from the oldest Chinese business association in the UK (CCBUK) and China Investors Club (CIC)

InnovateUK-Jiangsu/Shanghai Industrial Challenge Programme

- £10 Million available for UK company

- Open Innovation including Life Sciences & Med-Tech

- China Medical City is located in Jiangsu Province, next to Shanghai

- China Medical City could help to identify partner and provide supports for this type of grant application

- Deadline for registration-21st June

Conclusions

- With many in-house experts, Beyond Lab is a medical specialist to facilitate CMC setting up a Incubator in the UK

- Aging population and chronic diseases are the global challenges and the market is massive

- CHINA and UK need each other and a best business ecosystem could be created if both countries work together

- The first CHINA-UK medical incubator is set up by CMC, BL and partners to provide short courses and technology transfer services to help small/medium UK companies raising fund and entering into Chinese Market

- CHINA –UK work together to cure human diseases and build better healthcare